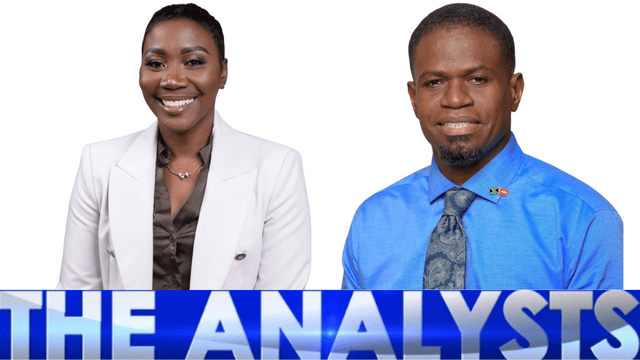

THE ANALYSTS: Mixed outlook for 2023

The Analysts of Taking Stock with Kalilah Reynolds have mixed views on how the stock market will perform in 2023.

Equity Trader at JMMB, Clive Charlton, said he is optimistic that the Jamaican Stock Exchange will begin to see a rebound in the new year.

“Here’s the thing: prices are already down. Financial stocks, which make up about 48% of the value of the overall index, those prices are at a low now and I don’t see them declining much further,” he said.

Charlton noted that the JSE’s financial index was the most heavily impacted by the Bank of Jamaica’s moves to curb inflation, which peaked at 11% over the summer.

The BOJ has increased its base policy rate ten times since September 2021.

“The base rate is what BOJ charges institutions for overnight lending and that adds value as it goes out into the economy into different products,” Charlton explained.

“Increasing interest rates will have a quick and immediate effect on the balance sheets of financial institutions because their substantial physical assets are financial instruments. So, once there is a change in interest rates, there has to be a change in the value of those instruments,” he explained.

However, the BOJ has indicated that they plan to temper their rate increases as the Jamaican economy becomes more stable.

Charlton said that Jamaica’s overall economic outlook has improved, which could signal a resurgence in the stock market.

He said many key sectors, such as agriculture, hospitality and retail, have been performing well. He added that the reopening of the Jamalco Bauxite Plant will boost the bauxite industry and Jamaica’s economy.

The Equity Trader also noted that point-to-point inflation in the US slowed to 7.1% in November.

“The US Federal Reserve said that they may not have a substantial increase in base rate again, but they expect interest rate to remain at the highest level. So it might plateau and augurs well for the US economy,” he said.

“So far, the various variables look well and we might see less distress in 2023 and I can see some recovery next year if interest rates stablise,” he added.

Bearish outlook for Bailey

However, CEO of Profit Jumpstarter, Keisha Bailey, is not as optimistic.

“I think next year is going to be a challenging year,” she said.

Bailey explained that many countries are experiencing inflation as a result of COVID-19 relief efforts implemented by Governments.

“A lot of the money that was being poured out by Governments into the economy is still floating around, which is why we’re having a problem with inflation. Come next year it’s gonna be a different story,” she said.

The CEO said she believes the United States is heading for a recession in 2023, which will trigger a chain reaction globally.

“The FED will likely raise the interest rate by another 50 basis points, but what’s going to be more important is the outlook, what is the Fed going to say,” she said.

According to Bailey, even though the US inflation rate has slowed, the Fed will likely still have less dramatic interest rate hikes.

“That means that we’re still going to have high interest rates and that’s going to have trickle down effects globally,” she said.

She explained that with every interest rate hike, the US dollar strengthens against currencies which will force Central Banks, especially those in countries that rely heavily on the US for trade, to keep up.

“Higher rates could put pressure on companies and we could see stock prices falling a bit more,” she said.

“I see more pain before gains,” she added.

Both analysts agreed that investors will have to take a longer-term approach to their investment in the new year, as there is still a level of uncertainty.

WATCH THE SEGMENT HERE

Fleetwood Takes Over Starfish Oils

The Cast Richard Coe Managing Director Fleetwood Jamaica David Rose Business Writer, Observer

Leave A Comment