How to WIN with a credit card

So you have a spanking new credit card! Buy now, pay later, right ? Or is it laugh now, cry later? Well it all depends on how you use and understand your credit card.

Understanding your credit card.

Credit cards can be very useful and convenient, but they can also be problematic if you don’t understand how they work. You know that Popcaan song, “mi only trust the bank and God...only trust the bank and God”. Well good for him for trusting the bank. I know a lot of people who don’t! Especially after all those fees start 'popping' up (see what I did there :-). So if you want to trust the bank, fine, but your personal finance should be your responsibility.

Over J$112 billion (US$768 million) in credit card transactions occurred in the first six months of the year, according to Bank of Jamaica (BOJ) data. This is down 12.5% from the same period last year. The decline comes amid the economic fallout from COVID-19 and is the first decline in years. The BOJ also revealed that the number of credit cards in circulation to June 2020 also fell slightly year on year to just over 333,000.

The situation gets worse when looking at USD credit cards. Jamaicans made only 130 thousand transactions with US dollar cards between January to June 2020, compared to one-million transactions over the same period in 2019! This suggests that a lot of people reduced their online spending during the onset of COVID-19, which gave them pause to examine their previous balance and charges in detail.

FX blunder

Recently, one of the banks in Jamaica made a huge billing error that affected possibly thousands of customers. They were billing customers 4 times the amount of their US dollar transactions! The error was in the rate they were using to convert US to Jamaican dollars. The current rate is between J$140 and J$150 to US$1, but people were being billed using a rate as high as J$500 to US$1! The bank at fault publicly apologized for the error and promised to refund its customers, but it's up to you as the customer to identify discrepancies in your charges. Don’t worry, I’ll help you spot such errors and understand your credit card interest and billing.

Let’s start with your billing cycle

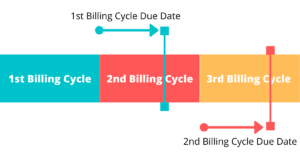

The billing cycle keeps track of your spending for about a 30 day period, and then it starts all over again. It’s the length of time between your last statement closing date and the next. The number of days in your billing cycle may fluctuate month to month. At the end of the billing cycle, you get a statement balance.

The statement balance is how much you owe from your billing cycle. As long as you pay this balance off in full you will not be charged any interest. YES you heard me right, you can avoid paying interest on your credit card IF you pay your balance in full every month. This is my personal strategy. I use a credit card rather than a debit card for most of my daily transactions, so that I can benefit from rewards such as airline miles and cash back. But I make sure to religiously pay off the balance in full on or before the due date so that I don’t get hit with those hefty interest charges. A good way to make sure you can pay it in full, is to simply not spend more on your credit card than you have in your main spending account. That way you can just transfer the payment from that account to your credit card at the specified time and boom! No interest! But you still benefit from free rewards.

So what happens when we can't pay our balance in full each month?

Let’s be realistic, while it's ideal to fully pay off your credit card each month, it’s not always possible. Sometimes you get hit with unexpected expenses, and you draw for that credit card because it’s convenient, even knowing full well that it may take some time to pay it off. Well that convenience will cost you heavily. When you use a credit card, you’re essentially taking a loan from the bank, so they will charge you interest. And guess what? Credit cards are one of the most expensive types of loans available! Did you know that in Jamaica, the average credit card interest rate right now is 40%? The lowest interest rate on credit cards locally is 34%. Still very high!

How do you calculate your interest?

Credit card interest is typically expressed as an annual percentage rate (APR). What you see on your bill is that annual rate; however, you get charged interest daily. The most affordable Jamaican credit card with 34% interest gets charged about 0.093% per day. In 30 days you get nearly 3% interest...

Step 1: 34 ➗ 365 = 0.093%

Step 2: 0.093 ✖ 30 = 2.79%

Now that we know the rate, let’s find out how much we’ll actually have to pay.

Let's say you didn’t pay your balance in full and you have a balance of $1,000 on your card - meaning you owe the bank a thousand dollars. In this example, we’ll start the billing cycle at the beginning of the month...so let's say on October 1 you owe $1000 on your card. On October 31st assuming you made no more purchases, then you would owe $1,000 plus interest.

Let's use the interest rate of 34% from our previous example. October has 31 days so that would give us a monthly rate of 2.88%. So that equates to interest of $28.80 or a new balance of $1028.80.

You don’t have to do all of this manually every month to figure out if your bank is billing you the right interest. You can put all this in a spreadsheet so that it calculates automatically. I love a good spreadsheet.

Here are some things that you should note…

The lower you keep your daily balance, the less interest you pay.

You can make payments on your credit card throughout the month to keep it as low as you can, and if possible pay your balance in full to avoid paying interest altogether.

Using a credit card does have its advantages:

- They facilitate online shopping whether for personal or business use

- They facilitate bill payment, which is especially convenient this year with the COVID-19 pandemic discouraging in-person transactions

- They’re convenient for bookings

- They’re safer to carry than cash

- You can collect rewards, mileage points, and cashback.

Between my husband and me, right now we have enough miles for our entire family of five to take a trip home to Belize, and those tickets can run as much as a US$1000.00 each. Unfortunately, because of the pandemic, travel isn’t the easiest or safest thing right now, so our travel plans are on pause, but best believe, those miles will get used.

Cash back is another great benefit. Our bank has offered the option to cash in our miles for money. This is a great option if you’re strapped for cash and don’t plan to travel any time soon. Personally I prefer to keep my miles. We did the math based on what they’re offering and the miles are still worth more to us, though your situation may be different.

Disadvantages??

Now on the other hand, in the con column, using credit cards exposes you to the risk of credit card fraud, and if you’re not disciplined with it, you may get hit with high interest charges. I’ve been there, done that. It took me literally years to pay off. Never again!

I now know how to use my credit card wisely, and like I told you earlier, I’m always monitoring the charges. Make sure you monitor your credit card statements diligently - not only for bank charges, but also for fraud.

Added benefit

Speaking of fraud, another benefit of using a credit card is that if you are a victim of credit card fraud, after the bank investigates, you usually get your money back. That doesn’t happen with cash. If someone steals your cash, it’s just gone.

Another Benefit is that it allows you to build your credit score for when you want to take out a loan in the future.

Definitely a major benefit. We plan on doing an episode on credit scores soon so look out for that

When I view your RSS feed it just gives me a page of weird text, may be the problem on my reader? TY for putting this up, it was very helpful and explained tons.

Hmm I’ll check with the web developer. Not sure what’s going on

Its such as you read my mind! You seem to know a lot about this, like you wrote the e-book in it or something. I believe that you just can do with some to force the message house a little bit, but instead of that, this is wonderful blog. An excellent read. I will definitely be back.

Thanks! Glad to have you and looking forward to interacting with you again