Hey you! I can see you! Hmm something looks different about your location. Did you extend the living room? Did you add a new room? Did you finally extend the driveway? Hmm..something feels different. Between COVID-19, curfews and spending so much time at home, many of you have started to put your plans to build onto the house in action. How do I know this?

Well…Caribbean Cement recently published their latest quarterly earnings and the jump in revenue and net profit tells me that we’ve dusted off our plans and started building. Caribbean Cement, operating since 1952, is the only cement-maker in Jamaica, so the more construction across the island, the higher their revenue will be.

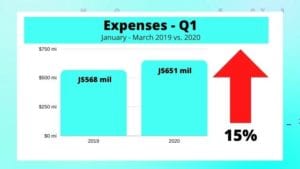

Carib Cement’s earnings for July, August and September have surprised some investors. Why? Well let’s look back at the earnings for January to March, the first quarter of 2020.

Between January and March, the company earned J$4.5 billion (US$375 million), a 2% increase when compared to the first quarter of 2019. However, they also had more expenses. So as a result, their net profit fell to under J$500 million (US3.3 million). That’s just a quarter of the profits they made in the same period of 2019-not a good start to 2020 at all.

Despite Covid-19, people losing their jobs and companies putting plans on hold to add to their operations, Caribbean Cement managed a slight increase in their revenue between April and June. They earned J$100 million more than the same quarter last year. Measures to bring down expenses resulted in net profits of J$521 million, almost 1.5 times 2019’s second quarter net profits. So that’s for the three months, April to June. But when we go back to January and look at the full six months, net profit was still down. They made about a J$1 billion, which sounds good but it’s 49% less than the first six months of 2019. Because remember January to March was bad.

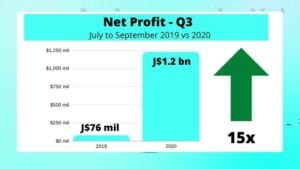

Some companies have been showing slight signs of recovery since the pandemic, but Carib Cement’s latest quarterly earnings show that they’re recovering better than some others. Revenue for the third quarter, that is July to September, was J$5.8 billion. That’s a 32% increase when compared to the same period in 2019. We also checked to see if the company has continued to bring down costs by looking at their profits. For the same three months in 2019, 38% of their revenue was gross profit. For this quarter, however, gross profit was 49% of revenue. This percentage, also called the gross profit margin, shows that the company has not only earned more money, but they’ve also spent less, which means that they have more to keep for themselves and share with us shareholders.

Net profit for the quarter came in at J$1.2 billion. That’s more than the net profit for the first six months of 2020. And not one, not two, but 15 times the net profit – J$76.8 million for the third quarter of 2019. This quarter’s net profit also resulted in a net profit margin of 21%, a big improvement over the 2% profit margin for the same quarter in 2019.

What happened?

Here are some answers:

1. Jamaicans have been doing some serious construction at home

2. Real estate developers have continued to build new spaces

3. Companies may have been using the downtime to do repairs and add new space

Now look at this!

Net profit for January to September alone – that’s nine months – was J$2.2 billion. That’s more than Carib Cement earned all of last year! They pulled in J$1.9 billion in 2019. If their net profit for these last few months of the year continues at this pace, they’ll be well on their way to having their best year ever! They’d even pass the J$2.5 billion they earned in 2018, which was their best year since starting operations in 1952; in the middle of a pandemic!

Now let’s look at their balance sheet

This shows that the company has been managing its cash flow well with cash of J$374 million. They also have receivables of J$408 million. This is less than last year, but we can also see where they’ve reduced long term debt from J$9 billion to J$4 billion dollars. This should result in less financial expenses and more net profit for us shareholders.

Future prospects

So what do you think about Carib Cement? Are they a good investment? With all the damage that the rain has done to the roads and drains and the government’s plans to carry out road repairs, it’s interesting to see what their financials will look like over the next year. And let me not forget the usual additions that we make at Christmas, or have you already done that?

-END-

Interested in Carib Cement stock? Contact an investment advisor at PROVEN Wealth @weareproven, PROVENwealth.com

Categories: MoneyMondaysJA

More #MoneyMondaysJA Episodes

Leave A Comment