THE ANALYSTS: New lotteries good for economy, stock market

By Anthony Morgan

THE ANALYSTS of Taking Stock have agreed that the Jamaican economy and stock market stand to significantly benefit from new players entering the multi-billion dollar gaming industry.

The Betting, Gaming and Lotteries Commission recently gave the go ahead for two new entrants to the market, Mahoe Gaming Enterprise and Goodwill Gaming Enterprise. Both companies have since ramped up their marketing strategies and started operations, breaking Supreme Ventures Limited’s almost three decade monopoly.

Business Writer at the Jamaica Observer, David Rose, said the situation will have a huge effect on SVL, which has already had to go on the defensive over controversial matters involving their selling agents.

There have been reports about agents being threatened with termination contracts because they registered to also sell games of at least one of the new competitors.

“You’re going to have a smaller contribution to SVL because you only have a fixed population, and Izizzi (Mahoe Gaming) and Lucky Play (Goodwill Gaming) have entered at the best time because we’re in an economic recession so you’re going to have more inclinations for people to see how best they can earn more money,” reasoned Rose.

He noted that the competition will lead to more dynamics in the gaming industry, with SVL already being forced to increase payout on games and to agents.

“They’ve [SVL] had this free space to play with all this time,” said Rose, adding, “Some of us look at investing in stocks for money, some of us real estate, but for some persons Cash Pot was the way they sent their kids to school, bought food, paid their bills and because of the competition, SVL has had to increase their payout. They were paying $260 before the new games, and then $280 after and now $305 just because of new competitors.”

Rose said while the new entrants may cause a reduction in Government’s tax revenue, the added competition will lead to a better environment.

“It’s going to be a very fun time going forward,” he said.

Too many baskets?

With its gaming monopoly gone, Supreme Ventures Limited (SVL) has also stepped up its diversification strategy. They recently acquired a 51% majority stake in the Kingston-based microfinance company, McKayla Financial Services Limited.

However, Equities Trader at JMMB, Clive Charlton, said he’s concerned about SVL trying to expand outside of its niche, especially now when others are looking to make their mark in the gaming arena.

He reasoned that while SVL does have the resources to fight, the company seems to be struggling with internal management issues.

“I think Supreme will be able to manage the competition and they are diversified, but do they have the in-house management leadership to run these mix of entities at the same time?” he questioned.

“Their [SVL] new entities make up a small percent, perhaps 2.5%, so they won’t impact them as yet but it will distract them [from gaming] to focus on growing these business lines,” he added.

In the meantime, Charlton reasoned that more competition in the sector will only increase the balance sheet of the overall industry.

“It will become a bigger pie and what sells are these smaller jackpots, so if they can come with more of those, it will attract more gamers,” he said.

Market reacts

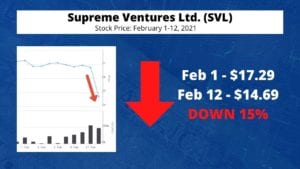

Meanwhile, the stock market has already started to respond to SVL having competition, a move which Investment Analyst at PROVEN Wealth, Julian Morrison, believes is a step in the right direction.

He said the new entrants are good for the market overall but believes they will have to do more to wrestle control from SVL, as the company continues to produce a very strong balance sheet with high cash balances.

“It’s a matter of how they use their treasure chest to respond to this competition,” he said, adding, “It’s round one of the fight. I don’t believe it’s going to be a first round knock out of SVL because of their strategic advantage; they are the Goliath in the space still.”

He said the domino effect has just begun, and could take an interesting turn should the other entrants also list on the stock exchange.

-END-

Ask The Analysts

The Cast David Rose Business Writer, Observer Leovaughni Dillion Investment Research & Sovereign Risk Analyst at JMMB Group

R.A. Williams to list on JSE

The Cast Audley Reid CEO R.A. Williams Distributors Julian Morrison Founder, Wealth Watch JA

Leave A Comment