Should the Bank of Jamaica Lower Interest Rates?

Several banking and finance execs are calling for the Bank of Jamaica to cut interest rates!

So the Bank of Jamaica recently announced that it’s keeping its base interest rate at seven percent, for now. The BOJ’s base policy rate is what the Central Bank offers to financial institutions. Banks use it to determine how much interest to charge you when you get a loan.

Interest rates have been high for the past three years because of inflation. But now that inflation is finally coming back down, several top bankers are calling for the BOJ to bring interest rates down too. Speaking on Taking Stock recently, Keith Dunnan, Chair of Jamaica’s Economic Programme Oversight Committee and CEO of JMMB Group said it’s time.

With base interest rates at seven percent, most of Jamaica’s financial institutions have increased interest rates on mortgages, car loans, insurance. Premiums on everything have gone up. Not to mention the impact it has on financial markets. The JSE only had one IPO last year and an APO that didn’t perform well.

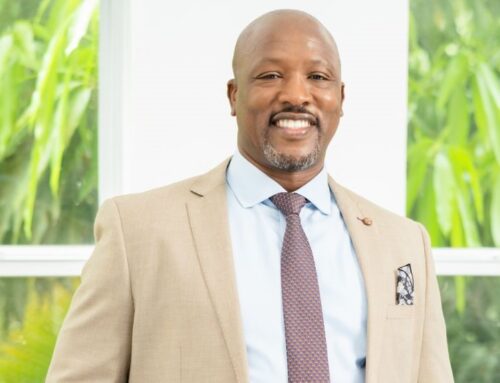

In an exclusive interview with Money Media, President and CEO of Sagicor Group Jamaica, Chris Zacca, echoed the call for interest rates to come down.

Meanwhile, at least one industry player thinks the BOJ will inevitably be forced to cut rates in the next two to three months.

Dan Theoc is Vice President of Investment Banking at Mayberry Investments.

So if the BOJ does move to reduce interest rates, what does this mean for you and your money?

Well, it means interest rates on loans would finally start coming down, making it more affordable to borrow money for a property, business, you name it.

On the investment side, it means the interest rates on bonds and treasury bills, what we call “government paper”, will also start coming down. Right now we’re seeing these pay out as much as 12-percent, but it seems that won’t last much longer. And once those interest rates come down, the stock market will start looking a lot more attractive again.

Stocks usually do poorly when interest rates are down, because if you can earn an easy 10 to 12 percent on bonds, why take the risk on stocks? But when bonds start paying less, the smart money is gonna start looking for another place to earn a decent return… cue: the stock market.

And that’s the Bottom Line!

Ask The Analysts

The Cast David Rose Business Writer, Observer Leovaughni Dillion Investment Research & Sovereign Risk Analyst at JMMB Group

R.A. Williams to list on JSE

The Cast Audley Reid CEO R.A. Williams Distributors Julian Morrison Founder, Wealth Watch JA

Leave A Comment