Pulse Investments considering alternative solutions for capital

By: Anthony Morgan

Pulse Investments has turned to alternative investment options to raise fresh capital, with its additional public offer (APO) delayed by COVID-19.

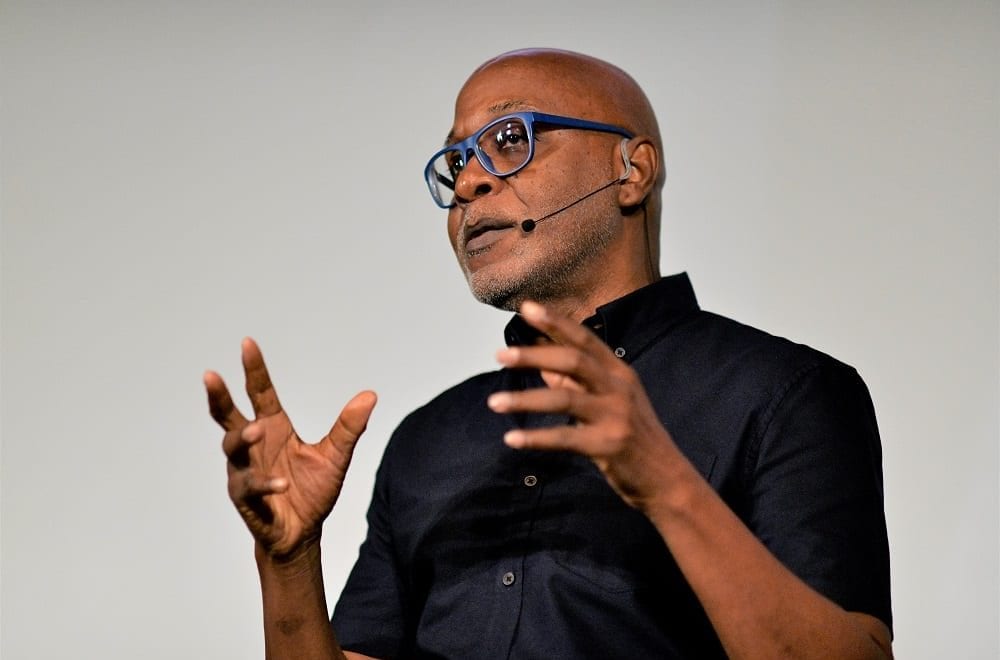

Chairman, Kingsley Cooper, told Taking Stock with Kalilah Reynolds recently that the company continues to look at other forms of funding to help fuel their growth, which he says he expects to be more diverse and international in the next five years.

“These plans are going to take a lot of cash,” he said, adding that, “Moving from the millions to billions is that kind of [multiple cash source] requirement you need to accomplish these objectives.”

Cooper said bonds are among the instruments being discussed for use, disclosing that the company has already secured some funding with an announcement expected in the coming weeks.

“We will announce soon once we are in the position to do so, because we have to tell the stock exchange first what we are doing…but plans are in the works and we are pretty advanced with a lot of it,” he said.

He said the company has also not ruled out the possibility of participating on the Jamaica Stock Exchange’s recently launched Private Market.

As for the company’s delayed APO, Cooper said the board will be looking at that option again in 2021 or 2022.

Pulse Homes still on track

Architect’s preliminary design for Pulse Homes at Villa Ronai

He said despite no APO funds, the company will be going ahead with projects that were put on hold due to the pandemic, including the homes being built on the nine-acre Villa Ronai property in St Andrew, which Pulse is acquiring from Cooper himself.

Construction of the Pulse Homes are scheduled to start in May and be completed by the end of 2022. Cooper said they are still waiting for the final building approvals in order to sell the three bedroom homes, being priced around $70 million (US$485,000).

“We are moving forward regardless and the APO will come. Whatever we have to do then, we will use that money to do it then. There is enough income to be generated in terms of our opportunities and selling the homes,” said Cooper.

Pulse Investments was the top performing stock of 2020, gaining a whopping 222% in the middle of the pandemic, and ending the year at $4.83.

Resilient portfolio

Cooper said the company’s real estate and television portfolios remained resilient over the year which helped the company maintain profitability.

“We have a number of spaces we rent at Trafalgar as well as Villa Ronai – that has been one of the strong performers. Television was also a big performer as we found broadcasters in new markets asking for additional programming,” said Cooper.

Real Estate accounts for almost 50% of Pulse’s portfolio, with TV taking up about 30%. It’s popular modelling arm, which took sharp decline with COVID-19, accounts for just under 10% of the company’s revenue.

Meanwhile, Cooper said Pulse might still acquire a substantial stake in Irie Jam 360 Media, a New York-based radio, TV and internet media group. The company had declared its interest prior to the outbreak of the virus.

“We hope in time to get that done,” he said.

Irie Jam 360 Media caters to a mainly Caribbean market in the tri-state area of New York, New Jersey and Connecticut.

-END-

Leave A Comment