Oil Prices Expected to Rise!

Looks like oil prices are going up again this year! And as you know, that drives EVERYTHING up! So brace for higher gas prices, food prices, transport prices, and much more.

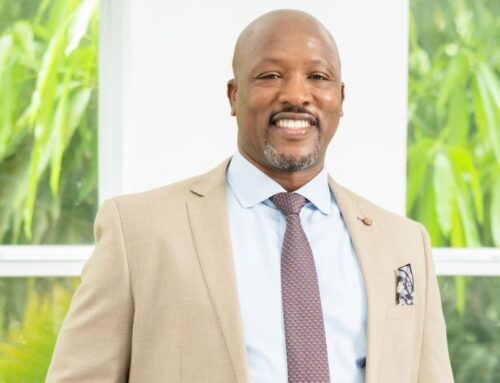

In a recent episode of my show Taking Stock, founder of Wealth Watch JA, Julian Morrison, discussed how various factors affect oil prices and the implications of major oil producers joining BRICS.

According to Julian, we’ll probably see a rise in energy prices within the next twelve months.

Why? Well, the war in Eastern Europe is still going and there’s another one in the Middle East plus there’s a drought in the Panama Canal. It’s a lot.

And you’re probably wondering what the Panama Canal has to do with energy costs. Julian explained that shipping delays will drive up energy prices because of the longer routes. It’s also gonna drive up shipping rates. But that’s another story.

In addition to the wars in Eastern Europe and the Middle East, that just amplifies the issues, resulting in shipping delays and disruptions in global trade routes.

Which in turn leads to higher energy costs and supply chain constraints, pushing energy prices even higher.

Let’s not forget the elephant in the room: fossil fuels. While there’s a push for green energy, the transition has been gradual, and fossil fuels still play a crucial role.

In fact, the production of electric vehicles touted as a solution to reduce greenhouse gas emissions, actually relies heavily on fossil fuels.

From mining raw materials to manufacturing components, fossil fuels are deeply intertwined with the EV supply chain.

So, until we figure out how to make green energy as efficient as fossil fuels, oil prices are likely to remain on the upswing.

So, what does this mean for you and your money?

With shipping rates on the rise and shipping routes facing challenges, it’s like a perfect storm.

Then there’s the formation of regional trading blocs and alliances, such as BRICS (Brazil, Russia, India, China, South Africa), which major oil producers UAE, Iran and Saudia Arabia just joined.

So you have countries prioritizing local production and consumption, leading to potential inflationary pressures, especially in energy markets.

This dependence highlights the significance of oil and gas in the near term, driving up demand and prices.

This benefits major producers like Guyana, amidst their newfound oil wealth.

The rise of regionalism in global trade, coupled with the gradual transition to green energy, adds to the uncertainty.

But there’s a silver lining for savvy investors.

According to Julian, it’s time to keep an eye on energy stocks like Exxon Mobil, which control the entire value chain and stand to benefit from rising oil prices.

Additionally, Jamaican companies involved in oil production, refining, and distribution, such as Regency Petroleum and FESCO, could see more demand and profitability.

It’s like striking gold in a sea of uncertainty. And that’s the bottom line.

Ask The Analysts

The Cast David Rose Business Writer, Observer Leovaughni Dillion Investment Research & Sovereign Risk Analyst at JMMB Group

R.A. Williams to list on JSE

The Cast Audley Reid CEO R.A. Williams Distributors Julian Morrison Founder, Wealth Watch JA

Leave A Comment