No More Taxpayer Bailouts for Financial Institutions

No more government bailouts for failing financial institutions!

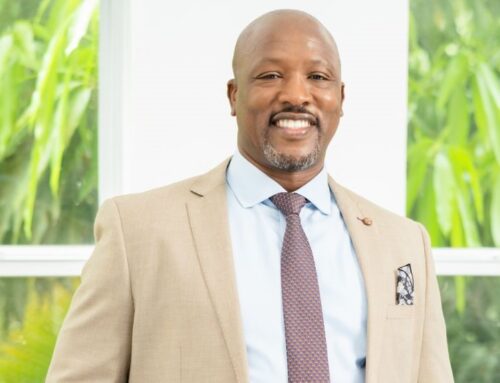

So when financial institutions need rescuing, taxpayers foot the bill. But Bank of Jamaica Governor Richard Byles says that will soon be a thing of the past!

Byles recently announced that the country will be introducing new legislation to protect taxpayers from having to bail out struggling financial institutions.

See, when banks or other financial institutions go under, it can cause some serious problems for the economy and for people who have money saved in those institutions. The most recent example, SSL.

That’s why the government often steps in to bail them out. They want to stop a chain reaction of more financial disasters and keep the economy from tanking.

Unfortunately, us taxpayers are the ones who end up paying for these bailouts because the government uses our money to fund these rescue missions.

It may not be ideal, but it’s done to keep the economy stable and to make sure regular folks don’t lose their hard-earned savings.

But the BOJ is now saying the government will be putting policies in place to ensure that failing financial institutions do not burden the public with debt.

You have to wonder how many bailouts are actually happening.

Byles says we can look out for new laws that will streamline things in the financial sector, such as putting the central bank in charge of regulating all financial institutions in Jamaica. This is part of what’s called the ‘twin peaks’ regulations.

The reforms are expected to be completed within the next two years. It means the BOJ will oversee insurance firms, investment houses, and fund managers.

But if the BOJ takes over that role, what will happen to the FSC?

According to Byles, the Financial Services Commission will be focusing more on market conduct rather than regulating these industries.

And that’s the bottom line.

Ask The Analysts

The Cast David Rose Business Writer, Observer Leovaughni Dillion Investment Research & Sovereign Risk Analyst at JMMB Group

R.A. Williams to list on JSE

The Cast Audley Reid CEO R.A. Williams Distributors Julian Morrison Founder, Wealth Watch JA

Leave A Comment