NCB sells controlling stake in Bermuda bank

Why is NCB selling a chunk of its highly profitable financial business in Bermuda.

NCB Financial Group is selling a chunk of their stake in Clarien Group, a financial company based in Bermuda.

NCB’s ownership stake is falling from a majority 50.1% to 19.9%.

So who are they selling to? Cornerstone Financial Holdings, owned by Michael Lee Chin’s protege, Paul Simpson. As you may know, Cornerstone/Simpson also owns Barita Investments, which they acquired in 2018.

This shift suggests that Cornerstone is making smart moves to buy companies.

In 2023, Clarien Group experienced significant financial growth. Their revenue grew by 23% and their net profit doubled to $1.72 billion.

No doubt these successes contributed to NCB Financial Group’s combined net profit of $15.3 billion.

So why is NCB selling? With a recent under-performing APO, a US$4 million bond payout in Barbados and lower than usual stock prices, could NCB be strapped for cash? We asked Taking Stock analyst, David Rose.

“Putting it into perspective, NCBFG, the holding company has J$36.8 billion worth of debt that was maturing between October 2023 and September 2024. So the debt pile to refinance is pretty heavy,” Rose said.

Pretty heavy indeed.

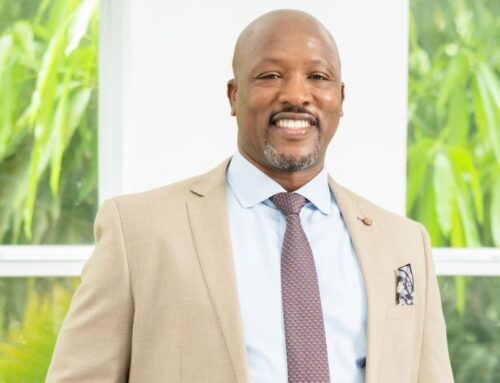

However, NCBFG’s CEO, Robert Almeida says the move is all part of their grand plan to shuffle their capital around smartly. And shuffling they are!

As for Cornerstone, we’ll have to wait and see what their plans for Clarien are. There’ve been rumors for years that Cornerstone-slash-Barita have been interested in started a bank. This acquisition gives them a stronger foothold in the Caribbean’s financial sector.

And that’s the Bottom Line.

Ask The Analysts

The Cast David Rose Business Writer, Observer Leovaughni Dillion Investment Research & Sovereign Risk Analyst at JMMB Group

R.A. Williams to list on JSE

The Cast Audley Reid CEO R.A. Williams Distributors Julian Morrison Founder, Wealth Watch JA

Leave A Comment