NBC APO could be a strategic move

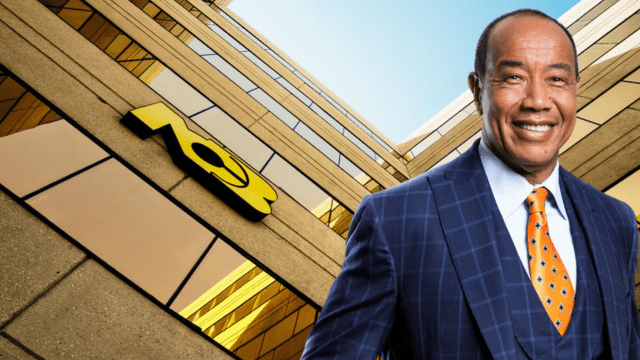

The Analysts of Taking Stock with Kalilah Reynolds say NCB Financial Group’s Additional Public Offer could be a strategic move to have an institutional investor come on board.

NCBFG announced last week that it intends to have shareholders vote on whether to execute an APO.

According to the company, the APO would see 300 million new shares created. At the company’s current market price, if the offer is fully subscribed, it would raise some $21 billion.

Business Journalist David Rose said that the move was unexpected, especially given the troubles NCBFG has been having.

“NCB wasn’t on anybody’s bingo card for raising capital through an APO this year. Remember this is one of the largest financial conglomerates in the Caribbean, so it’s surprising to hear that they are planning an APO,” he said.

He explained that the APO could be the company’s way of shoring up its books as the country gets closer to implementing Basel III. As the country’s largest financial institution, NBCFG will require more cash in its reserves than any other institution once the standard is implemented.

“Or it could potentially be to lower some of the debt at the NCBFG company level,” Rose said.

He explained that despite NCBFG’s market capitalization, the company would have still taken on debt when it acquired Guardian Group and Clarien Group several years ago.

Rose and the CEO of ProfitJumpstarter, Keisha Bailey, agreed that the APO could be a strategic move to have an institutional investor jump in.

“It could also be an opportunity for a large strategic buyer to enter and I think that may be happening and that would be very interesting,” she said.

Regardless of the motivations, Bailey and Rose said there’s a 50/50 chance on if the offer will be successful.

They said that while some investors may be itching to scoop up NCB shares, the company still has issues behind the scenes.

“Don’t get me wrong the private markets are quite active but in the same breath the public markets might not be the same,” Rose said.

“Because while the offer will probably be open in Jamaica and Trinidad the $21 billion is around US$136 million, which may sound small to some people but remember this is an institution that has not paid dividends in the last two years, has seen the departures of two top executives and will have new capital requirements soon,”

Rose said the company’s upcoming Extraordinary General Meeting will give more details about the APO.

The EGM is expected in October or November.

Ask The Analysts

The Cast David Rose Business Writer, Observer Leovaughni Dillion Investment Research & Sovereign Risk Analyst at JMMB Group

R.A. Williams to list on JSE

The Cast Audley Reid CEO R.A. Williams Distributors Julian Morrison Founder, Wealth Watch JA

Leave A Comment