MYNE Lend innovating microfinancing sector

Jamaica’s newest digital wallet provider MYNE Lend says it is trying to bridge the gap between Jamaicans and their access to credit by tapping into the FINTECH space.

MYNE Lend is a mobile app that provides micro-financing solutions through a digital wallet.

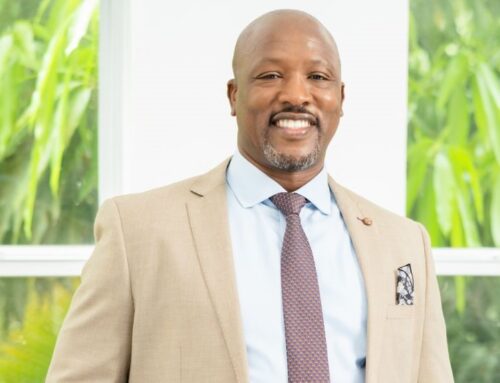

“We saw that there was friction between how ordinary citizens of Jamaica, the unbanked were able to access credit within the country and we though we could address that friction with technology,” General Manager of Flow Jamaica, Stephen Price said.

The app was created through a partnership between JMMB Group, Flow Jamaica and several international companies.

The wallet is only available to Flow customers, right now.

Speaking on Taking Stock with Kalilah Reynolds, MYNE Lend CEO, Elson James explained that the company is able to pool data from customers’ Flow history, and regular credit bureaus to make an assessment of their creditworthiness, within 10 minutes.

This will determine how much customers will be able to borrow. The maximum loan amount is $150,000 and with interest rates varying between 3.3% to 4% per month on the reducing balance of the loan.

Ask The Analysts

The Cast David Rose Business Writer, Observer Leovaughni Dillion Investment Research & Sovereign Risk Analyst at JMMB Group

R.A. Williams to list on JSE

The Cast Audley Reid CEO R.A. Williams Distributors Julian Morrison Founder, Wealth Watch JA

Leave A Comment