More stock sell-offs expected from fears about Omicron variant

Financial Coach, Founder and CEO of Profit Jumpstarter, Keisha Bailey expects the Omicron variant of COVID-19 to continue affecting global stock markets over the near term.

Stock markets across the world dropped sharply on Black Friday after the announcement of the new variant. It’s seemingly making people again worry about economic recovery.

The Dow Jones Industrial Average, in particular, had its worst day of the year, dropping more than a thousand points before recovering slightly to 905 points, or 2.5%. The S&P 500 and the Nasdaq Composite also slipped a little over 2%.

Financial Coach, Founder and CEO of Profit Jumpstarter, Keisha Bailey.

Over in the UK, the FTSE 100 index was down almost 4 percent and even main markets in Germany and France sank.

“Panic is here again. It’s a reason for concern, not yet a reason to worry but the market is feeling it, our pockets are feeling it as investors because a lot of these major companies have been having sell-offs,” said Bailey.

She said the fear that things are going to get worse has led to some investors cashing out. However at the same time, she said there are those who are taking gains because they expect stock prices to go lower.

She said as a long term investor, the situation could be viewed as a potential buying opportunity as a stock will not go down forever. She reasoned that a similar situation was seen back in March 2020 when there was a massive fall off in the market at the start of the pandemic. It had quickly rebounded after that.

It’s early inklings, further sell-offs expected in the Christmas season which is good, time to load up there,” she said noting that “these opportunities don’t come everyday but when they do come, it is time to cash in.”

Bailey noted that she too was busy all day Friday purchasing stocks, labelling the circumstance as her best Black Friday sale.

She said tech stocks in particular suffered heavily last week with the news, with the exception of Apple which investors are now viewing as a safe haven.

“The company is sitting on a whole lot of cash and the thinking here is that if everything goes haywire and the new strain becomes dominant then you want these companies that are strong, resilient. Apple for sure is one of those companies. I suspect that will continue to happen and that stock is one to watch.

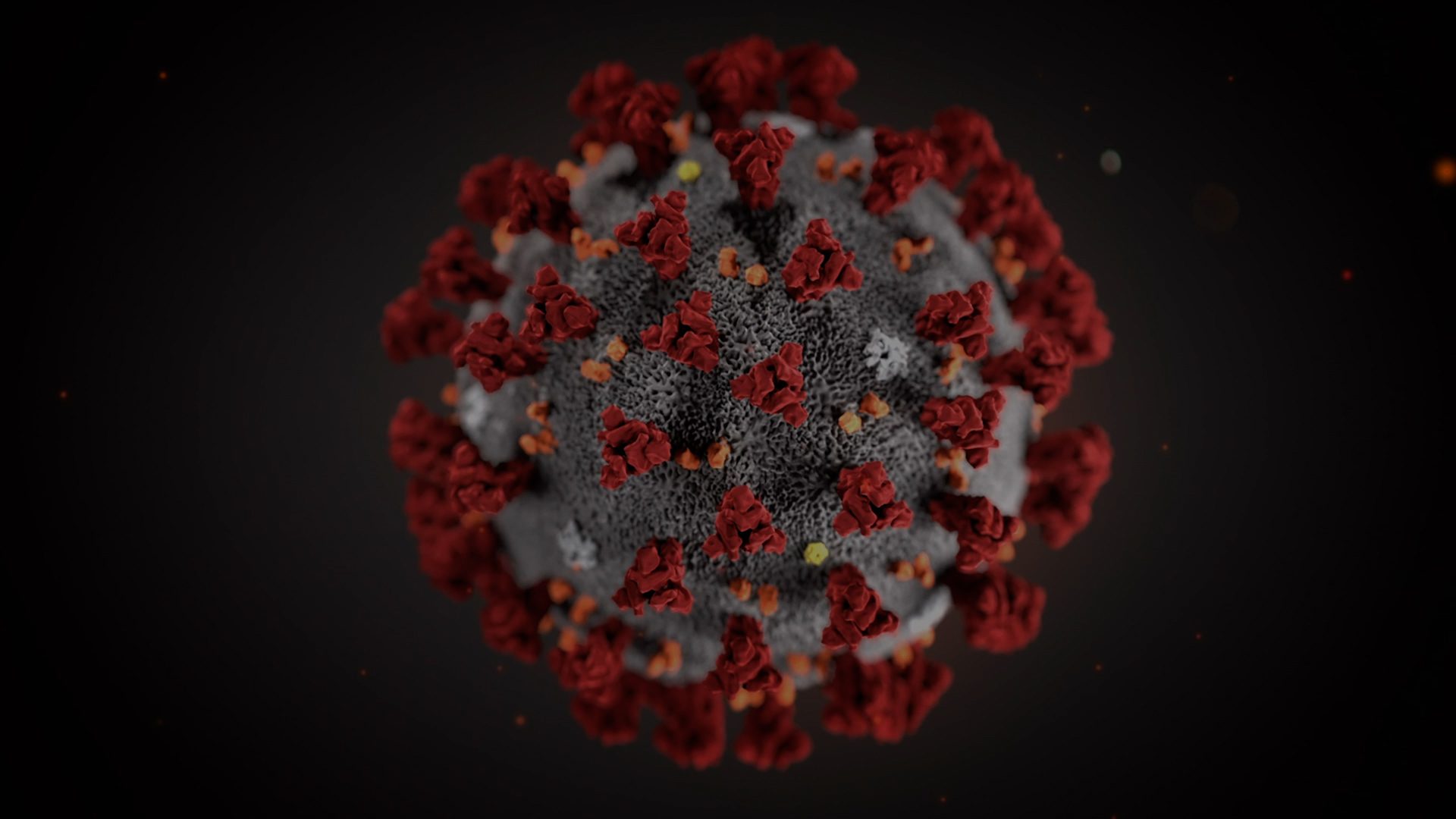

Omicron was first detected by South African Health Authorities. However, Dutch health authorities announced on Tuesday that they found the new variant in cases dating back as long as 11 days, indicating that it was already spreading in Western Europe.

Omicron has been classified as a variant of concern, alongside the Delta variant, by the World Health Organization (WHO). It’s now in more than two dozen countries.

Jamaica’s main trading partner, the United States, was among the latest nations to identify a case of the new strain earlier in the week. However Jamaica has so far only imposed travel restrictions on several African countries. In response to criticisms over that decision, the Health and Wellness Minister said it made sense at that time to impose a travel ban early on areas where the most cases were until further information became available.

-END-

Ask The Analysts

The Cast David Rose Business Writer, Observer Leovaughni Dillion Investment Research & Sovereign Risk Analyst at JMMB Group

R.A. Williams to list on JSE

The Cast Audley Reid CEO R.A. Williams Distributors Julian Morrison Founder, Wealth Watch JA

Leave A Comment