Larry Jones predicts real estate boom in 2024

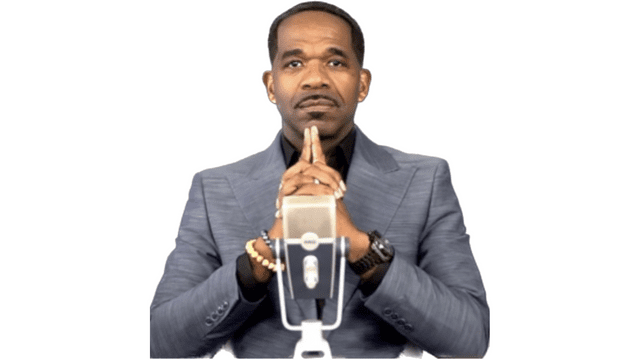

“The best time to buy real estate is at the end of a recession,” says US-based financial analyst and entrepreneur, Larry Jones.

He’s betting on 2024 as the perfect time to get into real estate.

Despite US government officials and economists refusing to formally declare that the United States is in a recession, the country recorded two consecutive quarters of negative economic growth, which has traditionally been the indicator of a recession.

Jones is an entrepreneur and host of STOCK UP! With Larry Jones on YouTube, with over half a million subscribers.

Speaking on Taking Stock with Kalilah Reynolds, he said that the labour and real estate markets are the only industries propping up the US economy from a “hard” recession.

He said the pandemic helped fuel a perfect storm for an extremely competitive and expensive housing market.

“During COVID, everybody fixed up their houses when they were at home. Our homes became our job, so everybody started fixing them up. They made their houses worth more,” he said.

He added that Governments across the globe also provided stimulus money to individuals, which helped them to renovate their spaces even more.

“Then the construction industry couldn’t build during COVID so the demand got even higher, plus with inflation, the prices of homes got higher. It was a perfect storm,” he said.

Additionally, he noted that central banks increased interest rates to beat inflation. That in turn, increases the cost of mortgages etc.

Overall, the financial analyst said that now is not the ideal time to dive into real estate investing, despite the market showing signs of cooling off.

Jones said he believes the US will enter a “hard recession” or face the brunt of the economic fallout from a recession in early 2023. Therefore, he said he believes it is best to wait until 2024 before entering the real estate market.

Best time for stocks

On the other hand, he said now is the best time to invest in the stock market, as recession fears, the war in Eastern Europe, inflation and interest rates have caused stock prices to tumble.

The S&P 500 is down almost 24% since the start of the year, while the DOW Jones is down 17% and the NASDAQ is down 33%.

Investors have been liquidating their shares and storing cash, and flocking to investments that they believe are more stable.

Jones said this fluctuation presents the best opportunity for long-term investors to buy into securities.

He said the stock exchange has a proven track record of rebounding after a dip.

Using the S&P 500 index as an example, he said that investors who held on during the initial pandemic fallout in 2020 would have doubled their profits this year.

“Every single time a recession or something similar happens, generally, one year later- after it bottoms out, you’re over 50% in profits,” he said.

WATCH THE INTERVIEW HERE

Ask The Analysts

The Cast David Rose Business Writer, Observer Leovaughni Dillion Investment Research & Sovereign Risk Analyst at JMMB Group

R.A. Williams to list on JSE

The Cast Audley Reid CEO R.A. Williams Distributors Julian Morrison Founder, Wealth Watch JA

Leave A Comment