Heavy subscription expected for Derrimon APO

Derrimon Trading’s Additional Public Offer (APO) could face heavy subscription upon opening, according to THE ANALYSTS of Taking Stock. This, despite the company having some 41% of its assets, totalling $2.39 billion, financed using debt up to last year, and a debt to equity ratio of 2.60 to 1.00 for the same period.

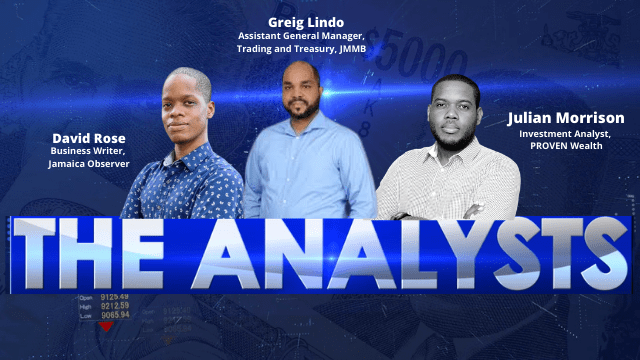

Investment Analyst at PROVEN Wealth, and Prime Minister’s Youth Awardee for Leadership, Julian Morrison, said the company’s debt to equity ratio should not be a cause for concern at this time, especially as Derrimon is positioning itself for growth over the short to medium term.

“Based on where debt to equity is, it’s not alarming,” said Morrison, who reasoned that Jamaica’s low interest rate environment allows Derrimon to borrow cheaply, therefore giving them the financial flexibility to grow fast and to pay down their debt at a faster rate.

Morrison said the company also has solid fundamentals, and will be using the minimum $3.5 billion dollars raised from the APO, to reposition the business to better manage its growth plans.

“Their savings are growing and they have been widening their footprint. I have confidence in the APO,” he added.

Meanwhile, Business Writer at the Observer, David Rose, said some of the company’s debt is actually tied to its redeemable preference shares issued in 2014 and 2018 to help the business grow faster and provide working capital.

Rose has projected that Derrimon’s APO will close early, and is anticipating who will make up the unreserved pool.

“It’s basically open and shut already because it’s fully underwritten by Barita Investments, the lead broker and arranger for the offer, so really and truly it’s to see how the market responds and who else will take up the offer,” said Rose.

He added that part of the proceeds from the APO will be used by the company to expand into Clarendon. According to the prospectus, Derrimon also intends to acquire two companies in the United States.

Derrimon already operates the Sampars Cash & Carry chain, two Select Grocers supermarkets in Manor Park and Cross Roads in Kingston and St. Andrew, Caribbean Flavours and Fragrances Limited (CFF), Woodcats International Limited and a distribution hub on Marcus Garvey Drive in Kingston.

One of its subsidiaries, CFF, has allowed Derrimon to remain listed on the Junior Market of the Jamaica Stock Exchange (JSE), despite the capital raise which is set to push the company seven times beyond the limit for the Junior Market.

Junior market companies are not allowed to hold more than $500 million share capital. Derrimon will be the exception. By moving to the main market, minority shareholders of the smaller company, CFF would have been at a disadvantage as that company would also have to migrate.

However under the agreement worked out with the JSE, Derrimon will be paying higher fees that apply to Main Market listings. Rose said remaining on the Junior Market will be a huge benefit to Derrimon as they are still entitled to a 50% tax break by law.

“That 50% tax remission is a saving grace to put back in the company to grow the business,” said Rose.

Assistant General Manager, Trading and Treasury at JMMB, Greig Lindo argued that its a situation the JSE will have to re-examine going forward. He pointed out that it was the same issue with Key insurance when Grace Kenndy took a majority stake in that company, forcing them to migrate to the Main Market.

But as for Derrimon’s APO, Lindo added that it looks like a good transaction on the surface, given that the use of proceeds should accrue benefits for shareholders.

“They will get the funds and it should be successful for them to move forward,” said Lindo. He said the company is in a good position at this time to return to the market.

-END-

Ask The Analysts

The Cast David Rose Business Writer, Observer Leovaughni Dillion Investment Research & Sovereign Risk Analyst at JMMB Group

R.A. Williams to list on JSE

The Cast Audley Reid CEO R.A. Williams Distributors Julian Morrison Founder, Wealth Watch JA

Leave A Comment