FESCO cites more sales, not price increase, for driving profits

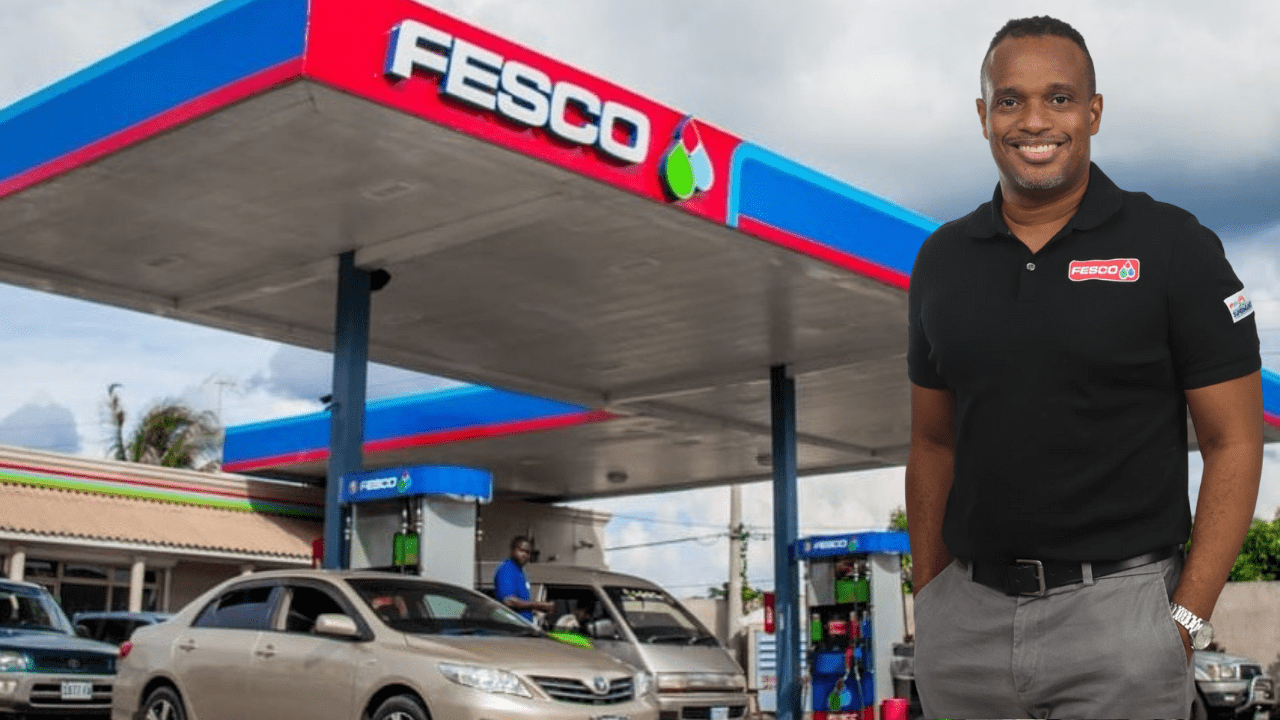

CEO of fuel distribution company, Future Energy Source Company Limited (FESCO), Jeremey Barnes, says that an increase in the volume of fuel sold has led to the company seeing more profits.

Speaking on Taking Stock with Kalilah Reynolds, Barnes said that contrary to what may be popular belief, rising gas prices have not been the major contributor to the company’s higher profits.

FESCO reported a net profit of $97 million for their fourth quarter ending March 31, 2022, a 162 percent jump from the $37 million recorded in the same period last year.

“We got tremendous support from the motoring public at all our locations and that’s what really drove our profits,” he said.

According to Barnes, the FESCO brand was not well known in Kingston and St Andrew prior to the opening of its two newest locations on Beechwood Avenue in Kingston and Ferry, St Catherine.

“Some people in Portmore would have been familiar with the brand but the opening up of both the Beechwood and Ferry stations gave more visibility to the brand,” he said.

He added that the publicity from their recent initial public offer has also led to greater patronage at its stations. FESCO’s stock has traded consistently around the $6-$7 region since March, up from an IPO price of 80 cents.

The CEO said that while higher pump prices have contributed to their profits, it is the overall increase across all the company’s business lines that has made a substantial impact.

“So, we do sell to the construction and manufacturing industries and those sales have also picked up. Generally speaking, sales across all divisions have increased; we’re selling more water, more oils, more lubricants. Everything has been better,” the CEO said.

Barnes noted that FESCO also tries to stay competitively priced to attract new customers.

He said that even as rising gas prices have been forcing some people to cut back, the company has not seen a reduction in the litres of fuel being sold.

“Actually, we sold more litres of fuel in April than we sold in March. What I believe is, yes people will cut back, but the economy has just opened up, a lot of people haven’t been able to visit their family or go to the country for a very long time,” he said.

“So, there’s a pent up demand for travel and we’re seeing that people are travelling,” he added.

According to Barnes, even though motorists may be cutting back at other fuel stations, FESCO’s competitive pricing makes them a top pick for filling up.

In regards to pricing at its various locations, Barnes said that most of the company’s stations are dealer owned and FESCO has no plans to step in and standardise pricing across all locations.

END

WATCH THE INTERVIEW HERE

Ask The Analysts

The Cast David Rose Business Writer, Observer Leovaughni Dillion Investment Research & Sovereign Risk Analyst at JMMB Group

R.A. Williams to list on JSE

The Cast Audley Reid CEO R.A. Williams Distributors Julian Morrison Founder, Wealth Watch JA

Leave A Comment