EXIM Express!

Small and medium-sized business owners can borrow up to $10 million dollars from Exim bank without providing their financial statements or without any collateral.

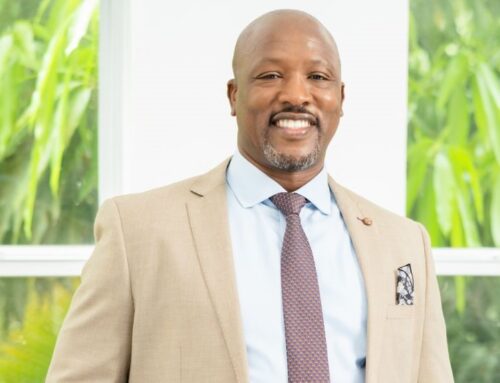

Business Development Consultant at Exim Bank, Winston Lawson, said that the bank’s latest financing solution helps provide funding to small and medium-sized enterprises (SMEs) that may be struggling to find it.

Speaking on MoneyMoveJa with Kalilah Reynolds, Lawson said the Exim Express eases some of the pressure business owners may feel when applying for loans.

“It oftentimes is very arduous to put together these (financial) statements especially as an SME,” he said adding that the bank does not take hard assets as collateral for the loan.

“So we won’t take your house, we don’t want your land, we don’t want your car. It’s (the loan) is pretty much unsecured,” he added.

Lawson acknowledged that granting unsecured loans is very risky business but added that the Exim Express loan has very strict requirements that companies must meet.

“As a Government institution we really have an obligation to ensure that, particularly those SMEs who are finding it difficult to access funding, we have to step up and make sure that they can avail themselves of the funding,” he said.

“We are not here to give away the funding and so we had to structure certain products to reduce the risks,” he added.

First, in order to qualify for the loan, companies must be doing business with either a Government agency, a company that is listed on the Jamaica Stock Exchange or a blue chip company. That company must in-turn owe the SME money, called receivables; then the bank will lend against those receivables.

“Your company does business with company A who trades on the JSE. Company A owes you $15 million. You can come to Exim and say ‘here company A owes me 15 million’ and under Exim Express the bank will lend you 75 percent of that receivable,up to $10 million,” Lawson explained.

He said that the business owner would then enter into a tripartite agreement so that when ‘company A’ is ready to pay, the money will be collected by Exim Bank.

He noted however that the payment must be ready in 90 days, as the loan is a short term facility. He said that the loan essentially allows business owners to carry on operations and not have their cash flow tied up waiting to be paid by a company or a Government agency.

The loan has a 2,5 percent interest rate and the minimum amount of money the company is able to borrow is $2 million and the maximum is $10 million.

Lawson noted that as the name Exim Express implies the bank is committed to a quick turn around for loan approval.

“We are committed to seven days… we are able to turn it around faster because we don’t have to go through the financial statements” he said. He added, however, that day one is considered as the day all the appropriate documents are submitted to the bank.

According to Lawson, although the bank does not require the business’ financial statements, every bank has Know Your Customer requirements that must be followed.

He said that the Exim Express loan, which has been around for over two years, is available to businesses from any industry.

Moneda is a mobile-first cryptocurrency investment platform. There isn’t enough mobile accessibility in the world of cryptocurrency, and our team realizes that.

Leave A Comment