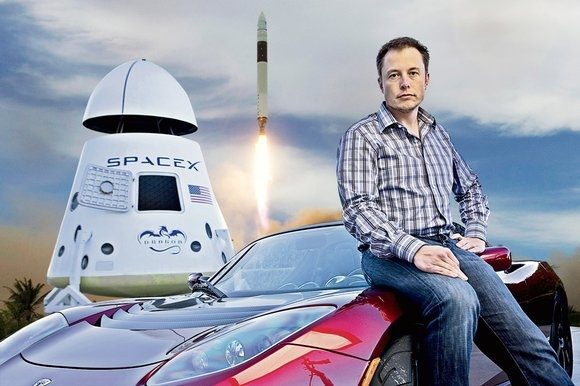

Elon Musk’s companies battling to make him even richer

Analysts and financial institutions continue to predict whether SpaceX or Tesla will be the company to propel the world’s richest person, Elon Musk, into the trillionaire realm, making him the first to do so in our time.

Musk is now worth more than ExxonMobil, with a net worth approaching US$300 billion.

He made the most of his money from his electric car company, Tesla, and some believe he stands to make even more through his space exploration business, SpaceX.

The space company charges about US$200 million for a trip to space and they’ve reportedly become the second most valuable private company in the world. Despite that, some still argue that Musk’s earnings from Tesla shouldn’t be overlooked.

Assistant Manager, Private Equity at PROVEN Management, Julian Morrison

Speaking on Taking Stock with Kalilah Reynolds, Assistant Manager of Private Equity at PROVEN Management, Julian Morrison reasoned that the overall situation has underscored the real value of long term investments in technology.

“It just goes to show that technology as a sector is basically in the lead in terms of growth because in certain value pockets we are in the innovation phase. What we are seeing is that inventions or new creations that were basically seen as science projects maybe 10 years ago, are starting to show practical use and because of that more funds are starting to flow towards those channels of value,” he noted.

Among those channels of value he referred to was the electric vehicles. Tesla recently got a major boost from car rental company Hertz, which has ordered some 100,000 vehicles to add to their fleet as part of efforts to meet environmental and social governance (ESG) guidelines.

“Companies across the board are looking to become more environmentally and socially responsible and in order to do that they would have to slightly change their business model,” said Morrison.

Research and Strategy Analyst at Sagicor Investments, Jodian Aris,

Research and Strategy Analyst at Sagicor Investments, Jodian Aris agreed that the deal with Hertz will further propel Tesla’s financials.

She reasoned that Hertz purchasing the cars will not only bring the billionaire led company added monetary gain, but also widespread advertising and marketing at no extra cost.

“When it is that you have these cars out there, people renting them, there is now an opportunity for people to test drive for over a period of time and get more exposure to EV cars so there is going to be a little bit more spill off to come from that end,” she said.

Aris further reasoned that Tesla’s stock also stands to be more popular over SpaceXs due to their operational timeline and the level of risk involved, should both companies be compared.

That’s a position also held by Wealth Advisor at Ideal Portfolio Services, Dwayne Taylor, who said Tesla’s stock continues to look more attractive in his eyes with the company essentially looking to save the planet.

He said the introduction of EVs has ignited the tech industry with more exciting developments still being anticipated for the future.

Wealth Advisor at Ideal Portfolio Services, Dwayne Taylor

“I would put my money there,” he said, noting that “Tesla has proven time and time over that they are a company, possibly moving to between US$1000 and US$1500 per share. Their financials came out and one notable thing was the European sales of model three Tesla cars. It was at an all time high outdoing vehicles using petrol.”

-END-

Ask The Analysts

The Cast David Rose Business Writer, Observer Leovaughni Dillion Investment Research & Sovereign Risk Analyst at JMMB Group

R.A. Williams to list on JSE

The Cast Audley Reid CEO R.A. Williams Distributors Julian Morrison Founder, Wealth Watch JA

Leave A Comment