Dolla Ditches Guyana Expansion; Doubles Down on Jamaica

Dolla is trying to take over the Caribbean! The microfinance company is looking to expand into St Lucia and Barbados on top of its operations in Jamaica and Guyana.

Dolla Financial is waiting on the Bank of Jamaica to approve its plans to expand to St Lucia and Barbados.

Dolla has been aggressively expanding since it listed on the Junior Market last June.

They’ve opened a new location in Portmore, raised over $1.5 billion through a bond, and launched a whole subsidiary- Ultra Financier.

And Ultra has a pretty unique, at least for Jamaica, business model. The company lends between $500,000 and $150 million. It uses non-traditional assets like luxury watches and cars, property, jewellery, designer handbags, and luxury yachts as collateral.

They’ve also partnered with a couple of companies such as FosRich, to provide specialised financing options to customers. So they’ve definitely been busy.

And now they want to spread their wings into St Lucia and Barbados.

The company already has almost a dozen locations across Jamaica and one in Guyana. But as a licenced microcredit institution, they have to wait on the Bank of Jamaica to approve any further expansion.

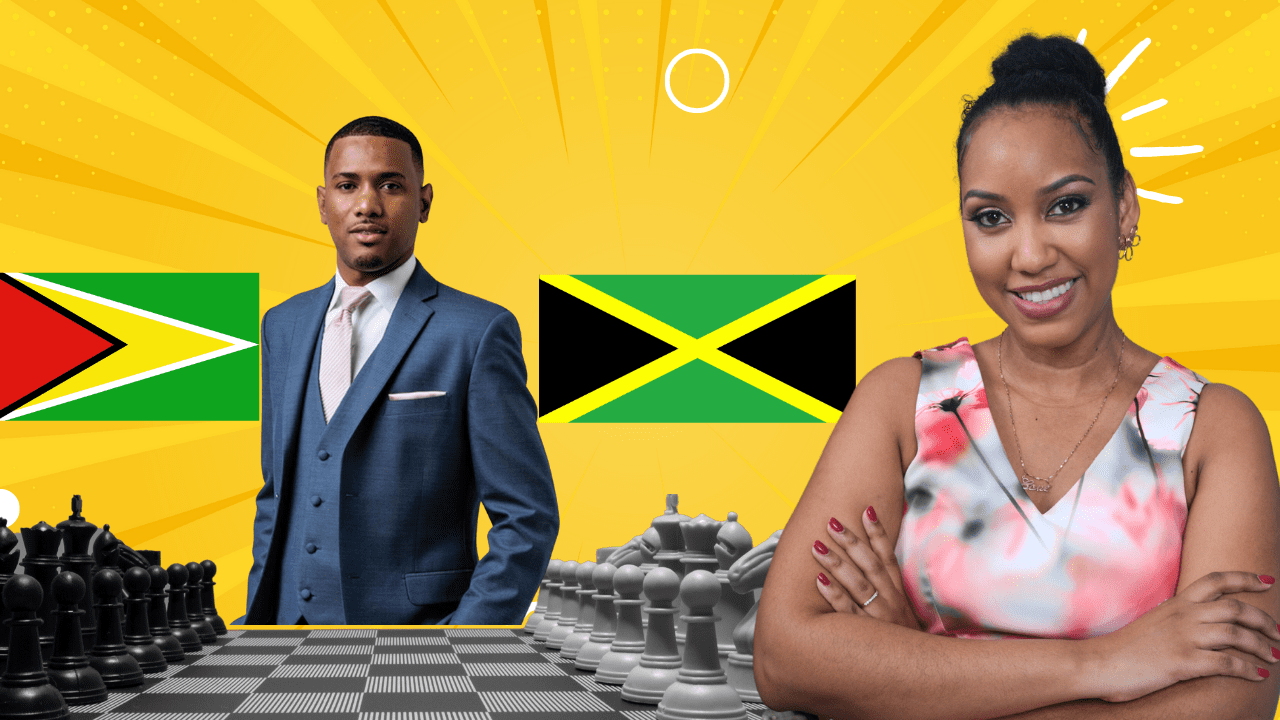

Now it’s kinda interesting that Dolla is trying to expand into two new countries because CEO Kadeen Mairs, announced during the company’s AGM that it was backing off its expansion in Guyana.

There’s already a Dolla store in the capital, Georgetown. The company had plans to open another store with funds from the bond offering. But Kadeen said they’re hitting the pause button on that for now. Instead, they’re focusing on learning the Guyanese market more before they open another location.

The Guyana location contributed around $37 million in earnings to the company last year. That’s 12% of Dolla’s total loan books. So it does really well. It makes sense they’d want to capitalise on that before they branch out.

Plus Kadeen said the company plans to open more locations in Jamaica, including one in Clarendon that is “ready to go”. But first, everything needs to be approved by the BOJ, which could take a while.

Ask The Analysts

The Cast David Rose Business Writer, Observer Leovaughni Dillion Investment Research & Sovereign Risk Analyst at JMMB Group

R.A. Williams to list on JSE

The Cast Audley Reid CEO R.A. Williams Distributors Julian Morrison Founder, Wealth Watch JA

Leave A Comment