Access to US, Canadian stock markets coming next week

After a lengthy delay, Jamaican investors can finally expect direct market access to US and Canadian stock markets as early as next week.

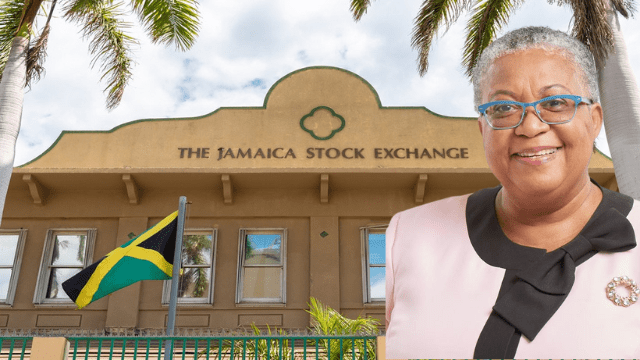

Managing Director of the Jamaica Stock Exchange, Dr Marlene Street Forrest made the announcement on Taking Stock with Kalilah Reynolds on Tuesday.

Direct market access would give Jamaican investors the option of trading stocks from stock markets in the US and Canada, from Jamaica.

Dr Street Forrest, who had previously promised that the initiative would be launched in February, said investors should have access by Monday or Tuesday.

“It is that far advanced… The pilot is being done and we should see it live by next week,” she said.

The Managing Director had also previously said that investing in these markets will be facilitated through local brokers. She said that various brokers have come on board to offer the service, however, she did not reveal the specific ones.

Short selling by year end

In another update, Dr Street Forrest said that the exchange is working to have short selling available to investors by the end of this year. She said that the initiative, which has been in the works for roughly two years, has been delayed by the COVID-19 pandemic.

Short selling refers to the act of borrowing a security and then selling it on the open market. Investors can then purchase it later at a lower price, pocketing the difference after repaying the initial loan.

“Many countries that do shorting, during COVID, they would have suspended the short market and we have had two years of COVID,” she said.

In terms of how the market will operate once short selling becomes available, she said that this option will only be done on a pool of securities rather than the entire stock market. She added that investors will also need to have their short sale backed by a position.

Circuit breaker rule here to stay

Meanwhile, Dr Street Forrest also gave a definitive “no” to the possibility of removing or revising the JSE’s circuit breaker rule.

Currently, the JSE’s circuit breaker ensures that no stock trades more than 15 per cent above or below its effective close price. The effective close price is determined whenever the closing bid is greater than the close price or whenever the closing ask is less than the close price.

If the stock rises or falls below the predetermined amount, then trading is halted for an hour to allow for a cooling-off period before resuming.

The Managing Director said that the circuit breaker is a valuable feature in ensuring market stability and the market is not interested in having the upper or lower limits removed.

“Remember that [the] circuit breaker is allowing for information to be disseminated, giving everyone an equal chance, whether it was that the price is going up or the price is going down, it doesn’t matter,” she said.

“The stock exchange is saying that we are here to ensure that there is an even playing field,” she added.

Longer trading hours

She did, however, say that the terms and conditions are under review, especially given the JSE’s short trading window. The market currently opens at 9 am and closes at 1 pm.

To that extent, Dr Street Forrest said that the JSE is considering extending its opening hours to allow for longer trading times.

She said the company has begun conversations with local brokers to explore the possibility.

“Because it’s not just an extension of trading hours like that, the brokerage community will have to be prepared for close of market operations,” she said.

She emphasised that no final decision has been made regarding whether the extension will be granted, and if so, the length of time it will be extended.

WATCH THE INTERVIEW HERE

<iframe width=”560″ height=”315″ src=”https://www.youtube.com/embed/B5J4txfBl3o” title=”YouTube video player” frameborder=”0″ allow=”accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture” allowfullscreen></iframe>

Ask The Analysts

The Cast David Rose Business Writer, Observer Leovaughni Dillion Investment Research & Sovereign Risk Analyst at JMMB Group

R.A. Williams to list on JSE

The Cast Audley Reid CEO R.A. Williams Distributors Julian Morrison Founder, Wealth Watch JA

Leave A Comment