No roll back on fuel tax but…

Financial Analyst, Dennis Chung says the Government is demonstrating fiscal discipline in the decision not to roll back the tax on fuel.

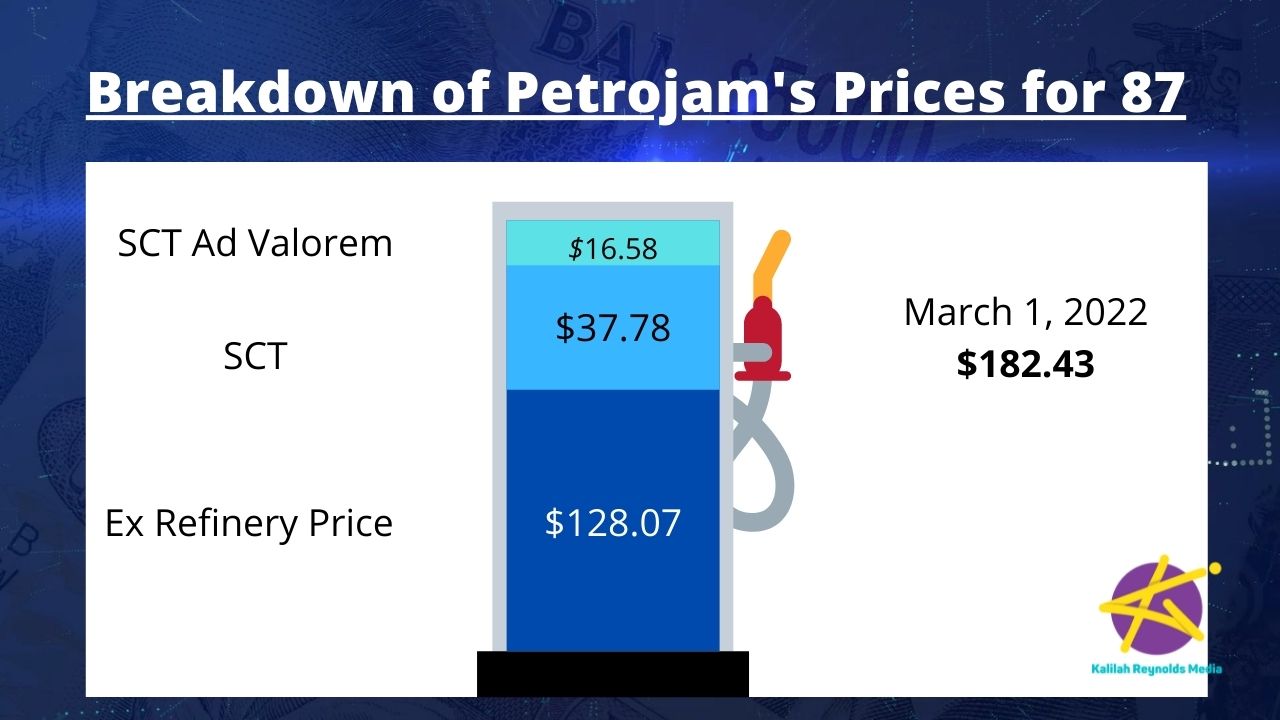

During his opening budget presentation to Parliament on Tuesday, Minister of Finance Dr Nigel Clarke said that the Government would not reduce the $7 per litre Special Consumption Tax (SCT) placed on fuel.

There have been calls for a reduction in these taxes, in the wake of high oil prices, now above US$120 a barrel.

However, the Finance Minister announced a $2 billion fund aimed a providing relief for those hardest hit by high gas prices. Minister Clarke said further details would be provided in his closing budget presentation.

Speaking on Taking Stock with Kalilah Reynolds, Chung said the decision indicates that the Government has a long term plan.

“It shows that there is fiscal discipline being practised and that is really what has guided us through the last two years,” he said, adding, “Rather than a rush to do something for short term gain, it’s a look at long term benefits.”

Chung further argued that reducing the tax on fuel could lead to an increase in demand for the commodity, which would in turn put pressure on the foreign exchange rate.

He instead supported the move to reduce duties on electric cars.

In his budget presentation, Minister Clarke announced that import duties on electric cars would be reduced from 30% to 10% for five years. However, this would be capped at one thousand cars per year.

Chung indicated that the government should go a step further by removing duties on renewable energy equipment and also beefing up the public transportation sector.

Meanwhile, the financial analyst also supports the Government’s call not to implement any new taxes in the 2022/23 budget.

“We are prioritising economic recovery. We want to achieve economic recovery in the quickest possible time. Increasing taxes at this time would run counter to that objective,” Dr Clarke said.

The announcement marked the fifth consecutive financial year where no new taxes were implemented and the seventh consecutive fiscal year where, on a net basis, the government has not increased taxes.

–END–

WATCH THE INTERVIEW

Ask The Analysts

The Cast David Rose Business Writer, Observer Leovaughni Dillion Investment Research & Sovereign Risk Analyst at JMMB Group

R.A. Williams to list on JSE

The Cast Audley Reid CEO R.A. Williams Distributors Julian Morrison Founder, Wealth Watch JA

Leave A Comment