Economy expected to remain weak for rest of the fiscal year

By Anthony Morgan

It could’ve been worse. That’s how THE ANALYSTS are viewing the preliminary figures on the economy for the third quarter as reported by the Planning Institute of Jamaica (PIOJ) recently.

The state agency said the economy declined by an estimated 11.3% between July and September, when compared with the same period last year. The contraction was largely due to the ongoing pandemic which led to a 13% dip in the Services Industries and a 3.6% fall off in the Goods Producing Industries.

The PIOJ figures give a guide to the outcome and require final verification by the Statistical Institute of Jamaica (STATIN), a separate but complementary agency. Once verified, the outcome would be the third consecutive quarter of decline since the onset of COVID-19 in Jamaica, but an improvement on the 18% drop between April and June.

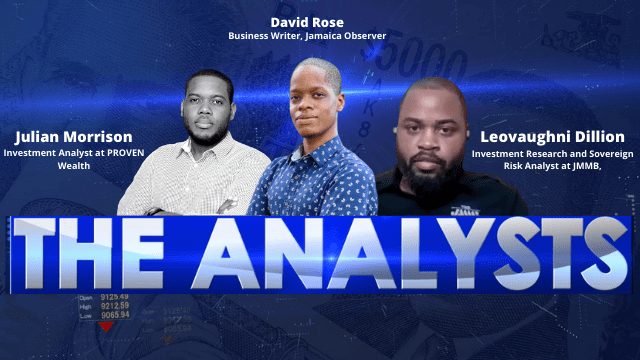

“Almost all industries were under significant stress even after the sharp decline in June,” reasoned Investment Analyst at PROVEN Wealth, Julian Morrison.

The data showed that all sub-industries within the Services Industries, except Producers of Government Services, declined over the period, with Hotels and Restaurants being the worst hit, down more than half or 63.8%

Over in the Goods Producing Industries, only Construction and Agriculture recorded gains. Morrison said it was interesting to see that these industries held up adding that the figures were supporting construction activity.

For instance, recent figures from Carib Cement–the sole producer of cement, showed the company on track to post its best year ever, a signal that activities have not slowed down in the construction industry.

The company made profit of $2.2 billion between January to the end of September 2020, which surpassed the $1.6 billion over nine months in 2019. In fact, it made more profit in nine-months this year than it made over 12 months in 2019 at $1.9 billion. It’s also $3 million below their 2018 earnings, which was their best year since starting operations in 1952.

Meanwhile, the buoyancy in the Agriculture Sector has been highlighted through the programmes implemented to help offload excess produce in the market with the fallout in tourism earlier in the year.

Morrison said the most recent figures were still much worse than expected, adding, “The numbers are saying we have much further to go.”

Business Writer at the Jamaica Observer, David Rose agreed that the outlook could have “easily been worse” especially as some containment measures, including the nightly curfew, were tightened over the period under review.

Rose expects the heavy rains in October to lead to some contraction in the upcoming October to December quarter. PIOJ projects that the rains and the pandemic will contribute to a contraction of up to 11% during the last three months of the calendar year quarter. It also projects that the full fiscal year could now decline by as much as 12% up from the previous forecast of 10%.

For Investment Research and Sovereign Risk Analyst at JMMB Group, Leovaughani Dillion, the situation remains unfortunate, but he says reports of COVID-19 vaccines are providing some positive news, which could spur a recovery.

-END-

Watch the full discussion here:

Ask The Analysts

The Cast David Rose Business Writer, Observer Leovaughni Dillion Investment Research & Sovereign Risk Analyst at JMMB Group

R.A. Williams to list on JSE

The Cast Audley Reid CEO R.A. Williams Distributors Julian Morrison Founder, Wealth Watch JA

Leave A Comment