At least 130,000 Jamaican jobs lost since COVID

Off the payroll

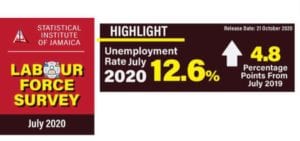

The economy lost over 130,000 jobs in July, largely due to the COVID-19 pandemic, lifting the unemployment rate to 12.6%, according to data from the July Labour Force Survey conducted by the Statistical Institute of Jamaica (STATIN).

July’s unemployment rate represents a 4.8 percentage point increase when compared to the rate of 7.8% recorded for the same period last year.

Finance Minister, Dr. Nigel Clarke says it reverses 4 years of work to add some 100,000 jobs to the economy between 2016 and 2020.

***

BOJ intervenes in FX market for a 3rd time in October

Meddling or helping?

The Bank of Jamaica (BOJ) intervened in the foreign exchange market for the third time this month. On Friday, October 23, it sold US$20 million dollars to Authorised Dealers and Cambios through its foreign exchange intervention tool (B-FXITT).

As with the other two interventions, the BOJ restricted the buyers from reselling the funds for more than J$0.20 cents higher than the purchase price. Additionally, buyers could only resell the USD to end-users who need it to pay for essential goods and services.

The total amount sold by the Central Bank this month alone stands at US$60 million. The interventions are aimed at slowing down the pace of the depreciation of the Jamaican dollar against its US counterpart.

The J$ opened trading on Wednesday, October 28 at $146.41 to US$1.

***

Wigton Windfarm eyes fresh capital

Blowing in more capital

Managing Director of Wigton Windfarm, Earl Barrett, says the company is likely to return to the equities market in the coming months to raise funds for its expansion plans both locally and in the region. Barrett made the disclosure at their Annual General Meeting last week.

Company financials

Wigton’s net profit for its June 2020 first quarter came in at J$300 million (US$2 million) from total revenues of J$751 million (US$5.1 million). That compares with $366 million in profit a year earlier on revenue of $833 million in 2019.

***

Gara opens 2nd Wendy’s during COVID-19

New opportunities

Gara Restaurants has opened another Wendy’s fast-food outlet even amidst the pandemic slowdown. The new outlet at the Super Value Town Centre on Constant Spring Road in St Andrew was commissioned at a cost of over J$100 million (US$685 thousand). It’s providing 30 new jobs.

Rapid expansion plan still on course

This is the second new restaurant they’ve opened in the last six months. The other is at Waterloo square.

***

JMMB group to speed up digitization

Going digital

Jamaica Money Market Brokers Group (JMMB) has signalled its intention to capitalize on more IT (information technology) solutions to grow the business. At their recent AGM, CEO Keith Duncan disclosed plans to improve the company’s digital solutions and implement phase two of their standardisation project.

What’s in it for you?

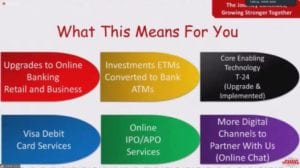

The improvements will see the establishment of a core platform across the three territories they’re in — Jamaica, Dominican Republic, and Trinidad & Tobago.

It will also lead to the roll out of card management systems, Intelligent ATMs, a mobile app and upgrades to the company’s online banking and investment services.

***

Jamaicans ditching cheques

Do you take cheques?

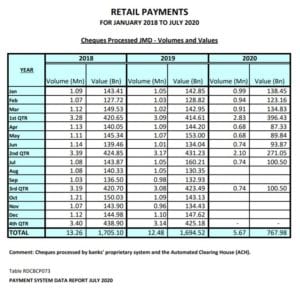

The number of people using cheques to do business has fallen by 33% since the onset of the pandemic.

Data from the Bank of Jamaica’s Payment Bulletin shows that just over J$100 billion (US$685 million) worth of cheques were processed in the central bank’s system in July 2020, down from J$160 billion (US$1.1 billion) in July 2019.

Cash use

But while cheque usage wanes, there has been some recovery in other retail activities.

Retail point-of-sale activity, for example, has surpassed levels from a year earlier, signalling that retail consumers are spending again, just not with cheques.

***

Catch WHAT’S HOT every Tuesday at 7pm inside Taking Stock with Kalilah Reynolds.

Leave A Comment