Carib Cement’s big third-quarter performance

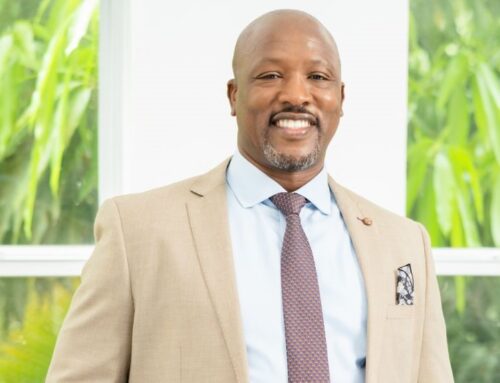

Business Journalist David Rose says Jamaica’s economic growth provided a significant boost to Caribbean Cement’s financial performance.

Speaking on Taking Stock with Kalilah Reynolds, Rose noted that the company saw a 13% increase in revenues for its third quarter, bringing in roughly $7 billion. Compared to the third quarter of last year, Carib Cement also saw a 60% jump in net profit to $1.9 billion.

According to Rose, the company’s improved performance can be attributed to the decline in distribution and financial expenses.

“They don’t have to be paying on preference shares any more and they’ve cleared up a lot of debt. So that’s why we saw this significant third quarter performance,” he said.

Rose also noted that Jamaica and Carib Cement was mentioned in the Cemex’s most recent report.

Cemex is a global building materials company and is the ultimate parent company of Carib Cement.

Cemex noted that the volume of cement distributed by Carib Cement has increased significantly.

Rose noted that an increase in tourism and infrastructure projects across the island, as well as an increase in exports, contributed to the increased volume distribution.

“Back in September, Carib shipped about 3,500 metric tons of cement to Turks and Caicos. So, you’re seeing Carib Cement start to benefit from Jamaica’s economic growth,” he said.

He also noted that Carib Cement has plans to increase its manufacturing plant’s capacity by 30% by the end of 2024 to early 2025. This boost in production will not only benefit the local market but the international market as well.

Despite the positive news, Rose noted that the company’s stock price has remained relatively unaffected.

The stock closed the week at $50.98, up slightly by 3% from the previous week.

“That could partly be because of the high increase rate environment and the fact that the market is down,” Rose said.

Carib Cement paid a dividend of almost $2 in October, and Rose said that given the company’s positive trajectory, they will likely continue declaring annual or semi-annual dividends.

Ask The Analysts

The Cast David Rose Business Writer, Observer Leovaughni Dillion Investment Research & Sovereign Risk Analyst at JMMB Group

R.A. Williams to list on JSE

The Cast Audley Reid CEO R.A. Williams Distributors Julian Morrison Founder, Wealth Watch JA

Leave A Comment